NZ Probate Unpacked: Your Essential Guide to Executor Duties & Avoiding Delays

The NZ Probate Process: A Step-by-Step Guide for Executors

Key Takeaways

- Probate is a High Court order confirming a will is valid and giving the executor authority to act.

- A grant of probate is generally required if the deceased owned land or held over $40,000 in a single institution for some classes of assets. .

- All NZ probate applications are processed centrally through the Wellington High Court.

- Executors carry personal liability and must wait at least six months before final distribution to protect against claims.

- Engaging a lawyer ensures all prescriptive High Court forms are filed correctly to avoid delays.

Being named an executor is a significant responsibility that often arrives during a time of personal grief. It is a role built on trust, requiring you to manage the legal and financial affairs of someone who has passed away. At DK Legal, we support executors by providing the clear, calm guidance needed to navigate the High Court requirements and estate administration duties.

The deceased person’s property, investments, and personal items are collectively known as their estate. As an executor, your primary duty is to carry out the instructions left in the will. This involves safeguarding assets, paying debts, and eventually distributing the remaining estate to the beneficiaries. Because executors are fiduciaries, they must act with absolute honesty and impartiality. Seeking professional advice is a practical step to ensure you meet your legal obligations and protect yourself from personal liability.

Understanding When Probate is Required

Probate is a specific High Court order that confirms the will is the last valid will of the deceased and formally recognises your authority as executor. While many people believe every death requires probate, the necessity depends on the nature and value of the assets involved.

Probate is mandatory if the deceased owned land or real estate in their own name. It is also required when a person held more than $40,000 with a single institution, such as a bank or KiwiSaver provider. If the estate consists only of small sums or assets held in joint names, you may be able to administer it using only a death certificate and a copy of the will.

When a person dies without a valid will, the process changes. This is known as dying intestate. In these cases, a court order called letters of administration is required to appoint an administrator to deal with the estate under New Zealand’s intestacy laws. For more information on why maintaining a current will is vital to avoid these complications, you can read our guide on why having a will matters.

The Seven-Step Probate Journey

The path from locating a will to receiving a grant of probate follows a strict legal sequence. Following these steps carefully helps prevent the High Court from issuing requisitions, which are formal requests for more information that can delay the process by weeks.

Step 1: Locate the Original Will

The first task is securing the original, physical will. Photocopies are insufficient for a standard probate application. Most original wills are held in a solicitor’s deeds system. You must also obtain the official death certificate from the funeral director or Births, Deaths and Marriages.

Step 2: Assess the Estate Value

Review the deceased’s assets to confirm if probate is necessary. Take a farm owner, for example. If they owned the land in their sole name, probate is an absolute requirement regardless of the cash in their bank accounts. Conversely, a small estate with no land and modest savings might be settled without court intervention.

Step 3: Engage Legal Support

While executors can technically apply for probate themselves, the High Court Rules 2016 prescribe very specific forms and language. Most executors choose to work with a lawyer to ensure the application is flawless. We assist by gathering the necessary details of assets, debts, and beneficiaries to build a complete picture of the estate.

Step 4: Prepare the Affidavit and High Court Forms

The application includes various forms. The most critical document is your affidavit, a formal statement where you swear or affirm your identity, your relationship to the deceased, and your belief that the document presented is the final will. Any irregularities, such as staple marks indicating a missing attachment or handwritten alterations, must be explained in this affidavit.

Step 5: File with the Wellington High Court

Since 2013, all New Zealand probate applications are filed centrally at the Wellington High Court. The application must include the original will, the signed affidavit, and the prescribed High Court fee, which is currently $269. We handle the couriering of these documents to ensure they reach the Probate Unit safely.

Step 6: Respond to Court Requisitions

The Court sometimes asks for clarification, especially if an executor lives overseas or if there are questions about the will’s condition. Our role is to manage this correspondence and draft any supplementary affidavits required to satisfy the Court’s concerns.

Step 7: Receive the Grant of Probate

Once the Court is satisfied, they issue the formal Grant of Probate. Straightforward cases usually take between four and eight weeks, though High Court backlogs can occasionally extend this to several months. You must wait for the grant before transferring or selling significant assets.

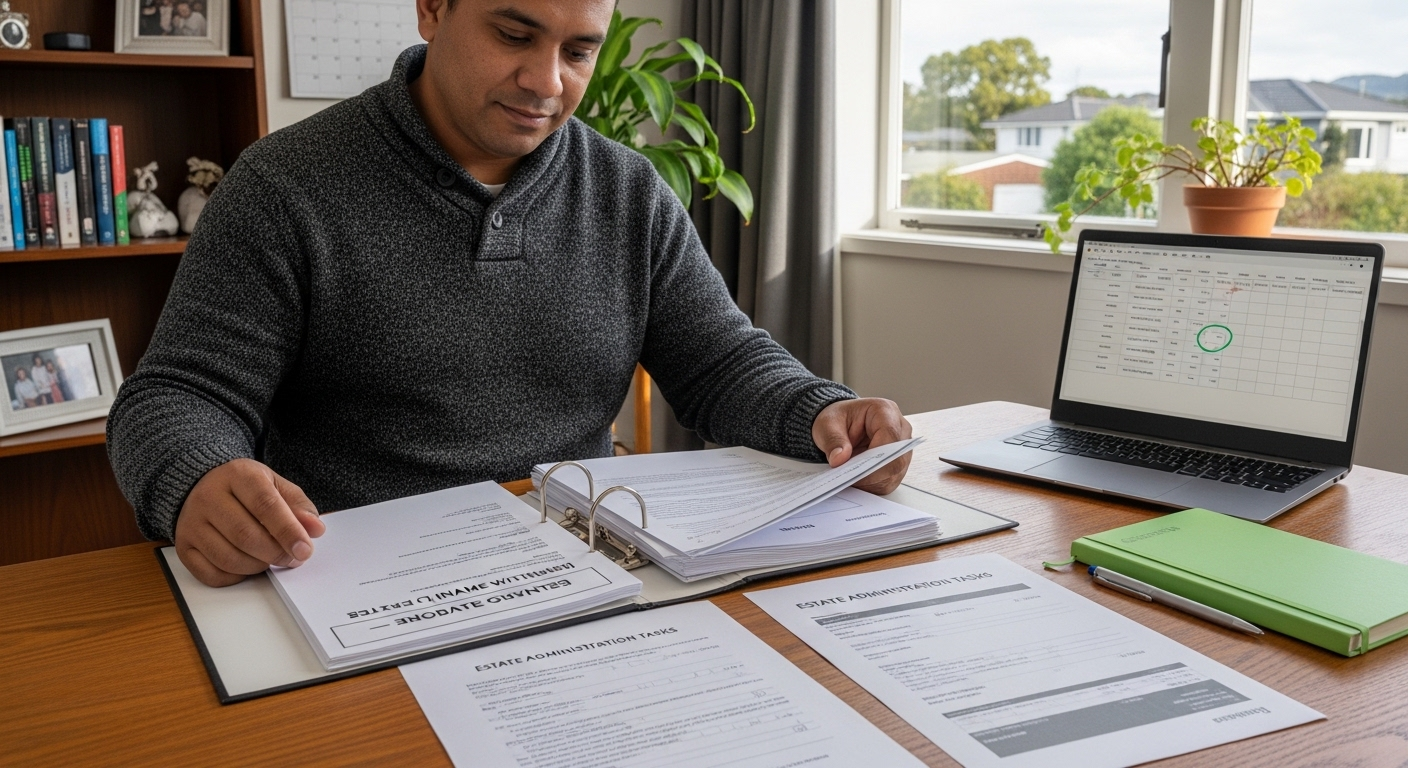

Administering the Estate After Probate

Receiving the grant of probate is the beginning of the practical administration phase. You will use certified copies of the grant to prove your authority to banks, insurance companies, and Land Information New Zealand. This allows you to close accounts, sell property, and call in funds from KiwiSaver or life insurance policies.

A common mistake is distributing the estate too quickly. New Zealand law allows a six-month window after the grant of probate for claims to be made against the estate under the Family Protection Act or other legislation. Executors who distribute the entire estate before this period expires can be held personally liable if a successful claim arises later. We advise keeping clear records and maintaining a dedicated estate account to manage funds during this period.

Effective communication with beneficiaries is essential. Regular updates help manage expectations and reduce the likelihood of disputes. If the estate involves complex structures like family trusts, you may also need to understand the duties outlined in the trustee's handbook to ensure all entities are managed in harmony.

Protecting Your Future Executors

The complexity of the probate process is often determined by the quality of the will left behind. A clear, professionally drafted will makes the executor’s job significantly easier and less expensive. Statistics show that less than half of New Zealand adults have a will, leaving many families to navigate the more difficult "letters of administration" process during a time of loss.

You can reduce the burden on your own loved ones by ensuring your affairs are in order today. Our team provides modern, accessible options for estate planning, including an online will service that allows you to start the process from the comfort of your home. Whether you are currently acting as an executor for an estate or looking to simplify the future for your own family, we are here to provide the expert support you need.